MODULE 1

Clean Up Checklist (QBO as a sample - concept applicable to other accounting software)

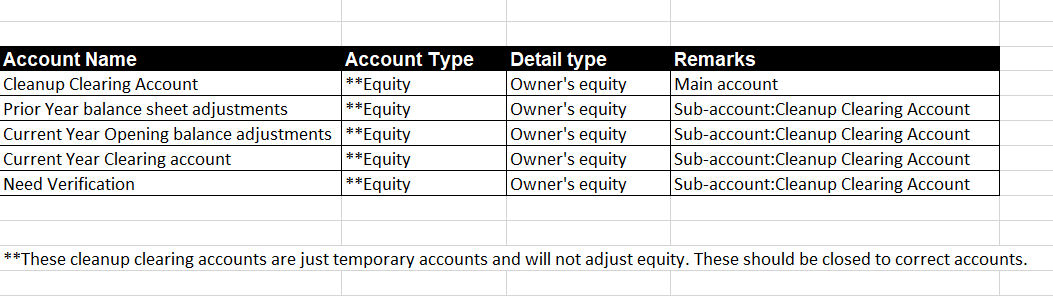

Cleanup Clearing accounts

We create Cleanup Clearing accounts to temporarily hold transactions

- Created until we get information from clients, tax preparers

- Created to close out to Retained earnings

- Created until decision is made

The Cleanup Clearing Accounts

- Cleanup Clearing Account - temporary account which is a parent account

- Prior Year balance sheet adjustments - temporary account used to record adjustments from prior year in bank reconciliation, uncleared banking transactions and other adjustments to Balance sheet

- Current Year opening balance adjustments - temporary account to record adjustments to opening balance adjustments to Balance sheet

- Current Year Clearing Account - temporary account to track adjustments clearing to zero

- Need Verification - temporary account to record adjustments that need verification and information from the tax preparer, client, etc.

- NO transactions should be remaining in Cleanup Clearing at the end of the cleanup

- Prior year adjustments should be closed to Retained Earnings account

- Current year adjustments should be categorized to their corresponding corrected accounts

Guide in Cleaning up which Periods

- If Tax return is filed in 2019, do the Cleanup for 2020

- If the owner wants to clean up periods in which return has done, the owner should discuss this with the tax preparer. Previous tax returns might have to be amended

- Do Cleanup only to periods for which tax return has not been filed

- If Tax return is filed in 2019, do the Cleanup for 2020

- If the owner wants to clean up periods in which return has done, the owner should discuss this with the tax preparer. Previous tax returns might have to be amended

- Do Cleanup only to periods for which tax return has not been filed

CLEANUP CLEARING ACCOUNT: PRIOR YEAR BALANCE SHEET ADJUSTMENT

- Closed out/adjust to Retained Earnings

- Period to adjust: Last tax return year-end date***

***Consider the effect of this on reconciliation to Schedule L

EXAMPLE ON CLOSING OUT THE RE

- Create a Journal entry to close out the Cleanup Clearing Account: Prior year balance sheet adjustments

- Adjust to Retained Earnings account

Cleanup Clearing Account: Current Year opening balance adjustment

- Closed out/adjust to according to your judgement

- Period to adjust: January 1 of the year being cleaned up

- You evaluate transactions recorded to this account and see if the amount is small or immaterial

- You decide whether to put adjustment to sales accounts or expense accounts

Example on closing out Current Year opening balance adjustments

- Create a Journal entry to close out the Cleanup Clearing Account: Current Year opening balance adjustments

- Adjust to desired account

Cleanup Clearing Account: Current Year clearing

- Period to adjust: N/A - should net to zero

Cleanup Clearing Account: Needs More Verification

- Adjusted to various account categories based on the nature of transaction after you get information.

Cleanup Clearing Accounts: Significance

- To organize the types of adjustments

- To gather more information before making decisions to what period to adjust and accounts to use

Overview

This is helpful when you do your audit checking of your client’s book like knowing the transaction volume and identifying affected accounts.

QBOA Tools

Accountant tools

- Reclassify

- Write off invoices

The “More” Menu

- Copy - duplicate the transaction

- Void - removes transactions but leaves a record

- Delete - completely removes transaction

- Transaction journal - debits and credits

- Audit History - shows audit trail

Audit Log

You can find voided or deleted transactions

Use Online app to convert

Convert to csv file

Create/Connect to Chart of accounts

Upload to QBO

Mapping

If you connect online with QBO, you can only bring in 90 days of worth past transactions.

Upload manual historical transactions that were not brought in from the bank using csv format.

In uploading manual transactions, be careful with the date range.

Bank Feeds (For Review)

Add: Creates an Expense or Check or Deposit

Transfer: Creates ‘Transfer Transaction’ from one balance sheet account to another balance sheet account

Match: It ‘applies’ to an existing transaction

Bank Feeds (For Review)

Green Category: QBO already guess on what the category should be based on past entries

Match: Matched to an existing transaction in the register

Rule: Matched to a Bank Rule

Bank Feeds

For Review: waiting for the user on what to do with those transactions

Categorized: already added to the register or matched from For Review status-either manually or via bank rules

Excluded: manually removed from the ‘For Review’

Bank Rules

For:

Money In: Deposits, ACH in or Credit Card Credits

Money Out: Bank debits, Checks, ACH out, Credit Card Expenses

Conditions: All or Any

Bank Text/Description:debits, Checks, ACH out, Amount: Less Than, More Than, or Between